FOR RELEASE ON Wednesday, October 4, 2017

Contact: Allan Baumgarten

Office 952/925-9121, cell 952/212-8589

Wisconsin Health Market Review 2017 finds:

Health Plans Continue Enrollment Growth and Improved Profitability

Consolidation and Insurance Expansion Boosts Profits for Wisconsin Hospitals

(Madison/Milwaukee) With fewer uninsured patients and increased market share, Wisconsin hospitals continued their strong profitability in 2016, even as inpatient hospital days declined again in Southeast Wisconsin. Health plans enjoyed improved profits, though partly offset by losses of three insurers on their individual plans.

These are some of the key findings in Wisconsin Health Market Review 2017, Allan Baumgarten’s tenth report analyzing Wisconsin’s health care provider and payer markets. The report, first published in 2003, is released here this week. He is an independent analyst and consultant on health policy and finance, based in Minneapolis, and publishes reports analyzing health markets in Wisconsin and seven other states: Colorado, Florida, Illinois, Michigan, Minnesota, Ohio and Texas. In New York, he has contributed the data analysis to five reports analyzing health insurance markets published by the United Hospital Fund. In 2017, he prepared a widely reported analysis of new provider-sponsored health plans for the Robert Wood Johnson Foundation.

In the new report, Baumgarten finds:

• HMO enrollment increased in 9 of the past 10 years and reached almost 2 million in 2016, the highest ever. Enrollment has grown in all lines of business: individual and group, Medicaid and Medicare. Health plans have combined, as three provider-sponsored health plans, Physicians Plus and Unity Health in Madison and Gundersen in LaCrosse, have joined forces and combined management under the Quartz brand. New health plans have formed, including two jointly sponsored by insurers and health systems. Wisconsin HMOs dodged a bullet when a legislative committee declined a proposal to self-insure the large state employees’ health plans.

• About 38% of Wisconsin seniors are now in a Medicare health plan, and the potential for additional, profitable growth is strong. Medicare plans are gaining popularity here and have been strongly profitable for companies like UnitedHealthcare, Humana and Security Health Plan.

• For the first time, HMOs had profits of more than $200 million in 2016. HMOs had net income of $214 million in 2016, or about 1.7% of underwriting revenues. However, four insurers, including Molina, Common Groundand Security Health (owned by Marshfield Clinic) posted large losses on their individual plans. Anthem Blue Cross Blue Shield of Wisconsin (not including its Compcare HMO) had net income of $81.2 million, or 10.7% of underwriting revenues.

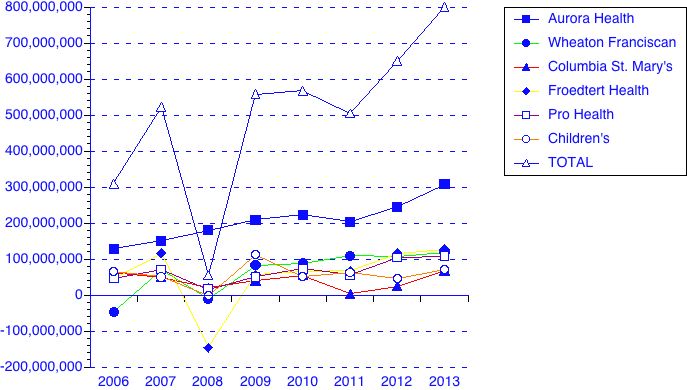

• Hospitals in the Milwaukee region reported net income of $796.4 million in 2016, or 10.5% in net patient revenue. However, that is down from an average margin of 12.3% in 2014. Aurora Health was the most profitable, with net income of $404.4 million, or 16.2% of net patient revenues. The Ascension hospitals in the area, now including the Wheaton Franciscan hospitals, reported an average margin of 4.6% in 2016. Hospitals in and around Madison had net income of $211.9 million, or 7.3% of net patient revenues, down from margins of 8.3% in 2015.

• The hospital systems in Southeast Wisconsin remain profitable even as inpatient utilization continues to decline. Systems continue to make large capital investments in new and rebuilt hospitals, specialty centers and convenient care sites, even though they are competing for a shrinking pie of inpatient care.

• Mergers and acquisitions have created powerful provider systems in both southeast Wisconsin and in other parts of the state. The combined Ascension systems, including Ministry, Columbia-St. Mary’s and Wheaton Franciscan, had hospital patient care revenues of $3.306 billion in 2016, the highest of any system. Aurora is the second largest based on hospital revenues. Wisconsin systems have expanded into Illinois through acquisitions and new construction, and two of the large Madison hospitals are owned by systems from other states.

• Efforts by major health systems to build Clinically Integrated Networks have fallen short.

One has disbanded, and two key members of the other one dropped out, seeing the difficulty of gaining new contracts and revenues. Other partnerships, including Medicare ACOs, have been more successful for some Wisconsin systems.

Excerpts from the report, including the “Wisconsin HMOs at a Glance” page can be viewed at http://www.AllanBaumgarten.com. Copies of Wisconsin Health Market Review 2017 can be ordered for $160.00 at Baumgarten’s website, by calling 952/925-9121, faxing 952/925-9341 or sending E-mail to: Baumg010@umn.edu

Wisconsin Health Market Review 2014

finds:

Milwaukee-Area Hospitals Report Strongest Profits Ever Though Inpatient Days Decline;

Medicaid and Strong Investment Income Boost HMO Profits and

Implementation of Health Reform Transforms Individual Insurance Market

(Milwaukee/Madison) Milwaukee-area hospitals reported their strongest profits ever in 2013, even as inpatient utilization declined again. Boosted by improved investment income and Medicaid profits, Wisconsin HMOs reported stronger results. And the number of Wisconsin residents with individual insurance coverage has doubled.

These are some of the key findings in Wisconsin Health Market Review 2014, Allan Baumgarten’s ninth report analyzing Wisconsin’s health care provider and payer markets. The report, first published in 2003, is released here this week. Baumgarten, an independent analyst and consultant on health policy and finance based in Minneapolis, has published reports analyzing health markets in Wisconsin and ten other states: Arizona, California, Colorado, Florida, Illinois, Kentucky, Michigan, Minnesota, Ohio and Texas. In New York, he has contributed the data analysis to five studies of health insurance markets published by the United Hospital Fund.

In the new report, Baumgarten finds:

• Southeast Wisconsin hospitals had net income of $800 million or 12.3% of net patient revenues.

That margin is the highest for these hospitals in at least the past 10 years. The previous high margin was 9.7% in 2007 and again in 2012. Five of the six systems in the area reported margins about 10% in 2013. Madison-area hospitals had net income of $205.5 million (8.3% of revenues) in 2013, up from $160 million in 2011 and $151 million in 2012. (See Exhibit 1 )

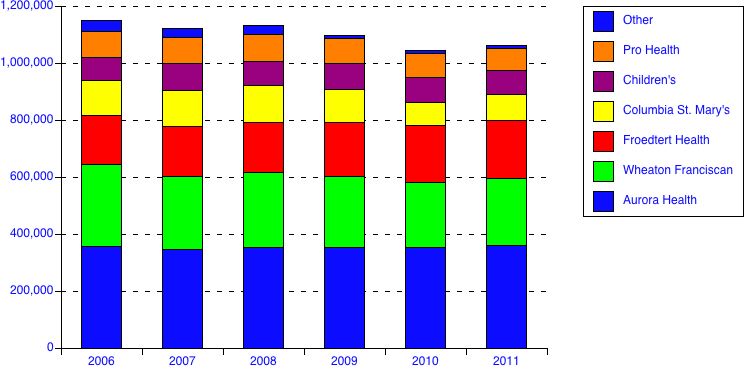

• Even though six new hospitals have built in the area in the past five years, inpatient hospital days have dropped by more than 7% since 2006.

While the Aurora system, including two new hospitals, delivered 7% more inpatient days in 2013 than in 2006, utilization at the other systems either decreased or was flat. (See Exhibit 2)

• Mergers and acquisitions have created powerful provider systems in both southeast Wisconsin and in other parts of the state.

While the Aurora system remains the largest in Wisconsin, Ascension Health, based in St. Louis and now including the 22 Columbia-St. Mary’s and Ministry hospitals, is now the second largest system. Smaller systems like Mercy Health, and Aspirus continue to expand into other communities and have crossed into nearby states. Two of the three hospitals in Madison are now owned by organizations from other states.

• Seven Wisconsin provider systems have formed Accountable Care Organizations (ACOs) for Medicare, and one ACO is among the most successful in the country.

These provider systems seek to better coordinate care and improve quality for Medicare enrollees, while saving money. If they succeed, they share in the savings, and the Bellin/ThedaCare ACO in the Fox valley has received $7.6 million in shared savings back from the Medicare program. Major systems have joined together to form alliances for contracting with health insurers.

• HMO enrollment grew again in 2013, as Medicaid health plans like Children’s Community Health and Molina Healthcare added 145,000 enrollees. However, enrollment in Medicaid HMOs dropped by 50,000 in the first half of 2014, as the state tightened eligibility for the program.

• HMOs improved their profitability in 2013, though it still lags behind previous years.

HMOs had net income of $73.6 million in 2013, or about 1% of underwriting revenues. That is better than 2012 ($54.4 million) but less than the previous five years. Profitability in 2013 was boosted by $82 million in investment revenue, much higher than usual, and improved underwriting profits for the state’s 17 Medicaid HMOs. Blue Cross Blue Shield of Wisconsin (not including its Compcare HMO) had net income of $70 million, a 10.3% margin, but less than in 2012.

• As a result of the individual mandate and new subsidies for coverage, enrollment doubled in individual plans sold by Wisconsin HMOs and insurers.

Three HMOs – Dean Health in Madison, Security Health Plan in Marshfield and Compcare Health Services in the Milwaukee area each added between 15 and 20,000 new individuals enrollees. And a new health co-operative, Common Ground Healthcare, went from zero to more than 27,000 enrollees in just a few months.

Excerpts from the report, including the “Wisconsin HMOs at a Glance” page can be viewed at http://www.AllanBaumgarten.com. Copies of Wisconsin Health Market Review 2014 can be ordered for $160.00 at Baumgarten’s website, by calling 952/925-9121, faxing 952/925-9341 or sending E-mail to: Baumg010@tc.umn.edu

Columbia-St. Mary's (Ascension Health)

Hospital Sisters Health System

The Alliance: Employers Health Care Alliance Cooperative

Rural Wisconsin Health Cooperative

Wisconsin Association of Health Plans

Wisconsin Collaborative for Healthcare Quality

Wisconsin Department of Employee Trust Funds

Wisconsin Department of Health Services

Wisconsin Hospital Association

Introduction................................................................................................... 3

Market Structure............................................................................................ 4

HMOs and Other Health Plans................................................................................................ 4

Hospital Systems...................................................................................................................... 7

Employer Purchasers................................................................................................................ 10

Trend Review ....................................................................................................................... 11

Health Plan Enrollment ........................................................................................................... 11

Individual Plans....................................................................................................................... 14

Medicaid Managed Care ......................................................................................................... 15

Medicare Plans ......................................................................................................................... 16

State Employee Plans .............................................................................................................. 17

Enrollment by Region .............................................................................................................. 19

Health Plan Net Income........................................................................................................... 20

Financial Metrics by Line of Business ..................................................................................... 21

Payment Arrangements ........................................................................................................... 26

Administrative Expenses.......................................................................................................... 28

Health Plan Capital Adequacy ................................................................................................. 29

Metropolitan Sub-Markets and Hospital Systems........................................... 30

Southeastern Wisconsin.......................................................................................................... 30

Madison Area ......................................................................................................................... 37

Other Major Hospitals ........................................................................................................... 40

A Look Ahead...................................................................................................................... 45

Wisconsin Health Market Review 2017 released October 3.

- Lauren Anderson wrote in BizTimes.com: Milwaukee Business News: "Analyst: Profitability of southeast Wisconsin hospitals remains strong."

- Sean Kirkby wrote in Wisconsin Health News: "Analyst: Hospital Consolidation, National Systems Change Wisconsin Healthcare Landscape." Click here to read.

- Sean Kirkby wrote in Wisconsin Health News: "Analyst: Wisconsin Insurers Consolidating, Offering More Narrow Networks and High-Deductible Health Plans." Click here to read.

Wisconsin Health Market Review 2014

released November 6, 2014: "Milwaukee-Area Hospitals Report Strongest Profits Ever Though Inpatient Days Decline; Medicaid and Strong Investment Income Boost HMO Profits and Implementation of Health Reform Transforms Individual Insurance Market"

- See Rich Kirchen's coverage in the Milwaukee Business Journal: "State HMOs See Shrinking Bottom Lines"

- Shamane Mills reported on Wisconsin Public Radio News: "Hospitals Still Make Money; HMO Profits Dip"

- Tim Stumm reported in Wisconsin Health News (subscription required): "Report: HMO, hospital profits dip slightly." And read Tim's interview with me released Friday, March 1.

- Presentation to Wisconsin Healthcare Financial Management Association,

February 11, 2014: "Health Care Provider and Payer Markets in Wisconsin: Key Trends and Issues"